Housing Market Gains Ground – Local Prices Rise

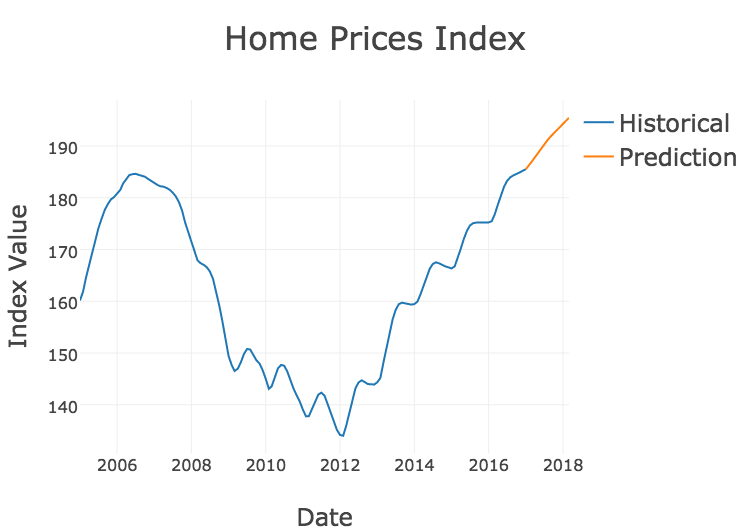

The nation’s residential real estate market continued its year-long rise in home prices in September, reaching the fastest annual rate since June 2014. The statistics in the S&P Case-Shiller U.S. National Home Price Index, released Tuesday, show a 6.2 percent annual gain, compared with 5.8 percent in August.

“Most economic indicators suggest that home prices can see further gains,” David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices, wrote in an analysis. “Rental rates and home prices are climbing, the rent-to-buy ratio remains stable, the average rate on a 30-year mortgage is still under 4 percent, and at a 3.8-month supply, the inventory of homes for sale is still low.

“One dark cloud for housing is affordability — rising prices mean that some people will be squeezed out of the market,” Blitzer said.

Case-Shiller also spotlights the housing boom-and-bust peaks, with the national index reaching its peak in July 2006 before hitting rock bottom in February 2012. Currently, the index surpasses the high mark by 5.9 percent.

Case-Shiller produces indices on three levels, nationally as well as 10- and 20-city composites. While the index does not include any cities in Southwest Florida, it said Tampa’s home prices rose 7.2 percent year-over-year in September and Miami’s went up 5 percent.

Future forecast

While the Case-Shiller report crunches the numbers on past sales, Realtor.com looks to the future in its annual National Housing Forecast.

The 2018 report, released Wednesday morning, predicts the inventory constraints that fed a marked increase in home prices will continue to subside since the trend began in August. Those higher prices presented obstacles to buyers entering the market, according to the real estate information and service website. Gains in inventory of homes for sale are expected to moderate price increases and to stimulate sales.

Asked about the forecast, Michael Saunders, the founder and CEO of Michael Saunders & Co, and Drayton Saunders, the company’s president, said the supply of homes was more healthy locally.

“Unlike the national numbers, our three-county area has been ahead of the curve on housing stock,” they said in an email. “This is a positive difference, unlike so many of our feeder markets which are struggling with the lack of inventory to meet buyer demands.

“Early indications would say that we will see a strong market in 2018 — with high demand and stable inventory. There is still a significant number of new home products available to provide options for the high demand.”